| Highmark Commercial Medical Policy - Pennsylvania |

| Medical Policy: | E-38-021 |

| Topic: | Continuous Rental of Life Sustaining Durable Medical Equipment (DME) |

| Section: | Durable Medical Equipment |

| Effective Date: | June 25, 2018 |

| Issue Date: | June 25, 2018 |

| Last Reviewed: | May 2018 |

This policy presents life sustaining DME items that may be rented continuously as long as the need exists for the equipment |

This policy is designed to address medical guidelines that are appropriate for the majority of individuals with a particular disease, illness, or condition. Each person's unique clinical circumstances may warrant individual consideration, based on review of applicable medical records.

| Policy Position Coverage is subject to the specific terms of the member’s benefit plan. |

While some items of durable medical equipment (DME) are for purchase only, numerous DME items can be rented or purchased. However, when an item of DME is rented, the total rental payments may not exceed the allowable purchase price of the item, unless the item has been identified as life sustaining DME. Life sustaining DME items can be continuously rented as long as the need exists for the equipment.

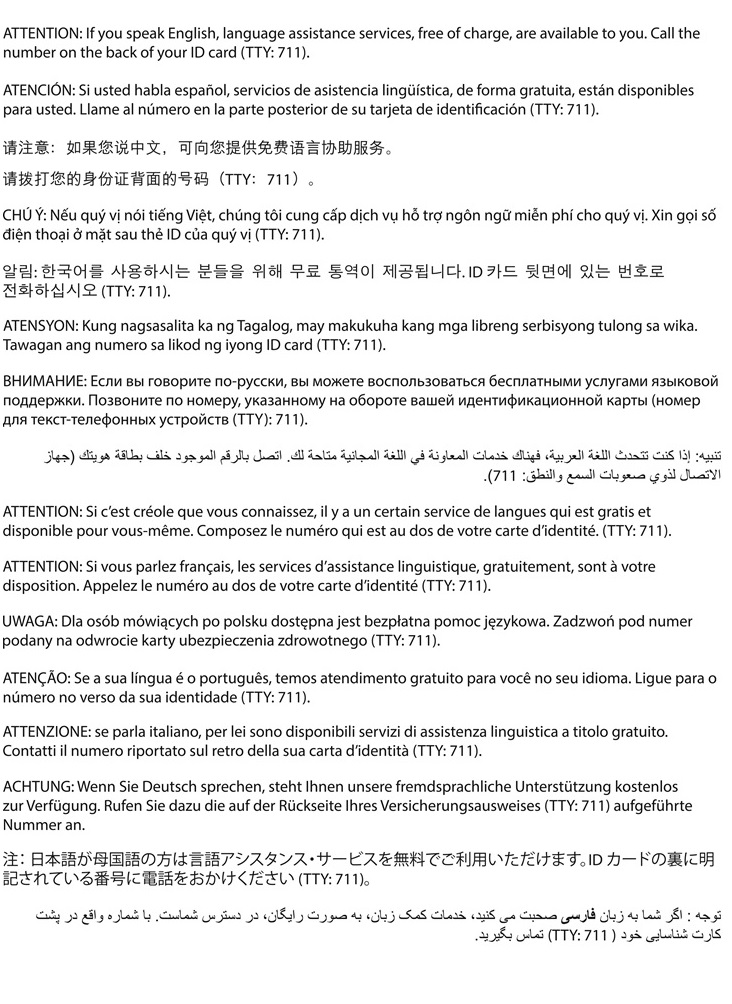

The following items are identified as life sustaining DME:

Refer to medical policy E-25 Home Pulse Oximetry Device for additional information. |

| Place of Service: Inpatient/Outpatient |

Experimental/Investigational (E/I) services are not covered regardless of place of service.

Continuous Rental of Life Sustaining Durable Medical Equipment (DME) is typically an outpatient procedure which is only eligible for coverage as an inpatient procedure in special circumstances, including, but not limited to, the presence of a co-morbid condition that would require monitoring in a more controlled environment such as the inpatient setting.

| The policy position applies to all commercial lines of business |

| Denial Statements |

| Links |

04/2017, Revised Criteria for Continuous Rental of Life Sustaining Durable Medical Equipment (DME)